Religion has always been and will be one of the most complicated topics for students to discuss. It is not a surprise that the subject of religion has often been the reason for disputes and even wars between nations. Therefore, experts often advise not to start conversations about beliefs in official circles. Still, to enrich general education, it is important to understand and distinguish the peculiarities of different religions, whether ancient greek religions, biblical Christianity, or the history of the roman catholic church.

Tasks related to religious teachings often cause embarrassment and difficulty for students. Indeed, even experienced specialists usually do not dare to take on such controversial subjects for their research. However, with this article, you can be calm because we did half the work – here, you can find the most interesting religious topics for your future essay.

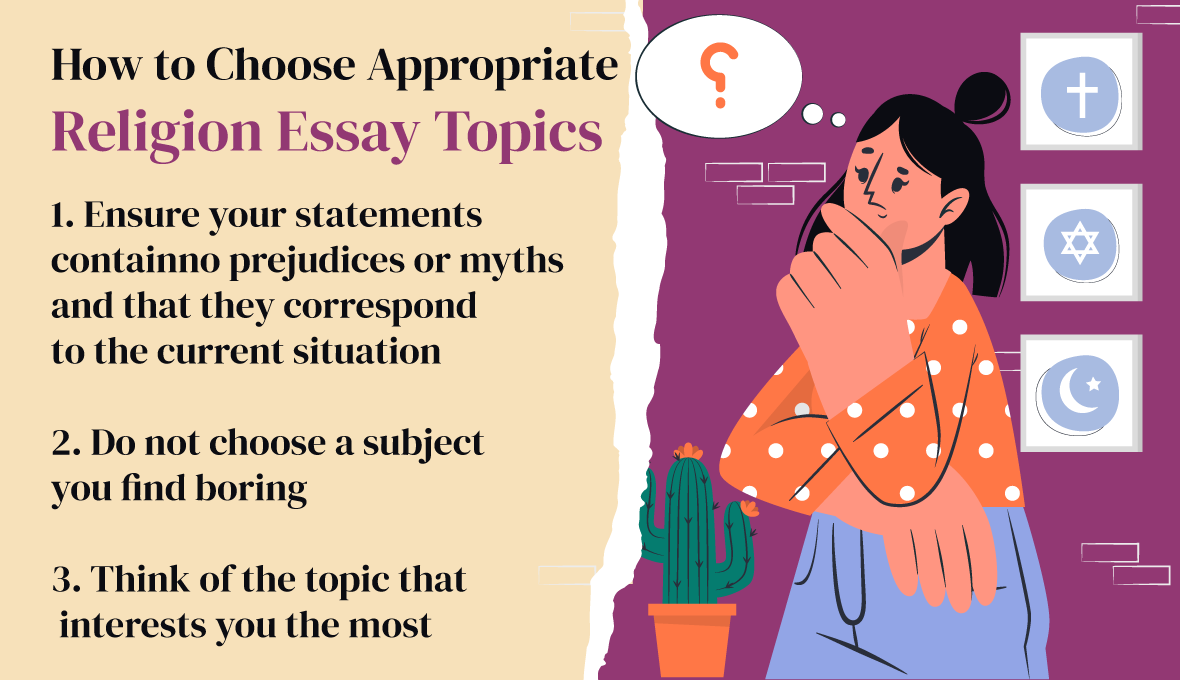

How Not To Be Mistaken and Choose Appropriate Religion Essay Topics

Before proceeding to the practical part of the work, it is necessary to get acquainted with some theoretical recommendations and scientific methods. To select the topic that will be both interesting for you and appropriate for the professor, stick to the following suggestions.

First, ensure the characteristics and statements you want to give have no prejudices or myths and correspond to the current situation. Thus, compile a list of reliable educational sources you will refer to while writing. Conducting comprehensive research is crucial if you want to make your work scientific.

Second, do not choose a subject you find boring. Personal assessments and judgments are unacceptable in publications. Separate them from the facts in the materials of analytical and journalistic genres.

Third, think of the topic that interests you the most. For instance, if history is your subject of interest, you can dive into the chronological development of a particular religion or contact to history paper writer. On the other hand, if you are more into cultural studies, choose beliefs central to national cultures and values.

The list you will find below covers all the possible religion paper topics that are interesting for a contemporary reader. Investigate it and find inspiration for your research. Finally, develop a thesis statement that can instantly hook your readers.

Academic Essay About Religion: Best Themes to Consider

The article's topic should always be interesting to read the text to the end. Especially when you want to impress your professor. Students tend to choose bland themes and therefore get lower grades.

So, it would be best if you directed all your efforts to making up the essay's title. Of course, you may also ask for help or say, 'write my paper' PaperWriter experts, and get a perfect piece complete. But do not start to worry in advance – we will help you to find excellent religious paper topics and improve your academic performance!

- Church and state in the modern world

- Religion and politics as forms of spiritual and practical development of the world

- Religion as a means of ideological influence

- Features of religious life under different political regimes

- Church symbolism: an explanation of the most significant symbols

- The rift between science and religion

- Interreligious dialogue

- Church and education: Recognition of Theology.

- Features of modern religious movements

- Comparing the moral ideals of different world religions

- The causes of the spiritual and moral decline of humanity in the XXI century

- Studying rational and irrational sides of religions

- Theocratic states of the modern world

- Semantic and life values of a believer

- Consequences of secularization of modern social life

- World religions and their attitudes towards women

- World religions and their attitudes towards cloning

- Conflicts between different religions in Europe

- Polytheism vs. monotheism

- Psychology of religion: how it affects a person's life and views

- Atheism, deism, and agnosticism – explaining the difference

- Features and examples of religious fanaticism

- Religion and the science of the origin of man and society

Humans are curious creatures, so asking a question and trying to find an answer to it is the best strategy for writing a high-quality academic essay:

- Will religions ever disappear?

- Do all religions lead to God?

- Who are Masons and what do they believe?

- Why don’t all people believe in God?

- What is paganism, and how do other religions perceive it?

- Are psychology and religion incompatible?

- What do well-known scientists say about faith, God, and the Church?

- Does the Church participate in public life?

- What is the purpose of sacrifices?

- Is it possible to change religion temporarily?

- Religious education in secondary schools

- Spiritual life in Roman Empire

Christianity is one of the most significant religions in the world today, so take a look at the most engaging Christianity essay topics:

- Difference between Christianity and other western religions

- Christianity and homosexuality

- Orthodoxy, Catholicism, and Protestantism as the main branches of Christianity

- Ancient Christianity in academic writings

- Christian doctrine and cult

- The issue of Schism

- Jesus Christ as a Christian messiah

- Religious perspectives of Christianity

- The role of the holy spirit in the Christian religion

- The figure of Jesus Christ for modern people

Topics to Illustrate the Buddhist Religion in Academic Papers

- The features of the Buddhist holidays

- Buddhism and vegetarianism

- Buddhism and philosophy in studying

- Studying the main teachings of the Buddha

- Buddhism as a spiritual path

- How is Buddhism different from Hinduism?

- Is Buddha a god or not?

- What does Buddhism say about heaven and hell?

- Is Buddhism a Pessimistic Religion?

Topics for College Students to Understand Islam Better

- Shiites and Sunnis: the difference between branches

- Fundamental principles and pillars of Islam

- A detailed explanation of Sharia, Muslim law

- Debunking the myths about Islam

- The study of the modern geographical spread of Islam

- What are the Muslim holidays?

- How do Muslims perceive other religions?

- What are the biggest sins in Islam?

Topics for Covering Christian Religion and Other Former and Existing Religion Systems

- Historical types of religious beliefs and modern religious systems

- Technological development from a spiritual perspective

- Understanding of religion from materialistic and idealistic value systems

- Fundamental dissimilarities between Christianity, Buddhism, and Islam

- Religion in British literature

- Fetishism, totemism, animism, and magic – are there still people who adhere to these beliefs?

- Learning the origins and consequences of the Reformation

- The influence of Christianity history on Native Americans

Just don't feel like it? Let us handle your task and go on with your life!

How to Write About Religion Avoiding Controversy

There is no doubt that religion is the most delicate phenomenon to discuss. Thus, in choosing religious topics for essays, a student must avoid discrimination, hate speech, and prejudice.

The golden rule says – you can not criticize or ridicule the meaning of beliefs, rites, or traditions of other nations. Moreover, avoid offensive definitions, negative stereotypes, and baseless labels in your academic paper. It is unacceptable to make a comparison of religions, from which it can be concluded that one prevails over the other.

Writing an essay about religions can turn out to be a real challenge for a student. Still, employing all the recommendations correctly is a direct way to creating quality and informative content. If this topic is still too complicated for you, you can contact our writing paper service.

Make Sure You Have Found an Appropriate and Interesting Topic for Your Paper

Hopefully, this article has helped you to get rid of that eternal student burden: what should I write about? The list we provided above is comprehensive yet inexhaustive. You are free to pick any topic and either extend or narrow it to your taste. Even if that doesn’t help and you are still confused – our experts are ready to provide their assistance.

In case you need professional help on choosing suitable religious essay topics, you can apply on the site and get feedback immediately. Just tell us "I need help writing my paper". Specify the requirements for your academic research, give more details about your preferences and the style of writing – and you will get a personalized selection of the best topics.

.png)

.png)

.png)

.png)

.png)

.png)

.png)